Saudi Arabia chemicals company Saudi Basic Industries Corp (SABIC) is evaluating an initial public offering (IPO) of its industrial gas unit, National Industrial Gases Company (NIGC).

The move comes amid restructuring as SABIC focuses on its core petrochemicals business, and would reposition NIGC for the energy transition.

SABIC’s global gases portfolio encompasses hydrogen, liquid argon, liquid carbon dioxide, nitrogen and oxygen. Operationally, it runs more than 60 sites across 43 countries.

An IPO could fund decarbonisation projects such as Saudi Arabia’s 4 million MT carbon capture hub which aims to open in 2030.

© SABIC

As part of its low-carbon proposition, it has incorporated captured CO2 as a feedstock under the ISCC carbon footprint certification scheme and opened the world’s first large-scale demonstration plant for an electrically heated steam-cracking furnace at chemicals giant BASF’s Ludwigshafen site.

In its 2024 annual report, Khalid Al-Dabbagh, SABIC Chairman, wrote, “The global push toward lower-carbon solutions, product circularity and energy transition is reshaping the industry, and SABIC is integrating these initiatives into its core portfolio.

“Rapid advancements in electrification, decarbonisation, and materials science are requiring our industry to adapt … as we look to 2025 and beyond, our focus will be on guiding SABIC’s transformation and unlocking new opportunities.”

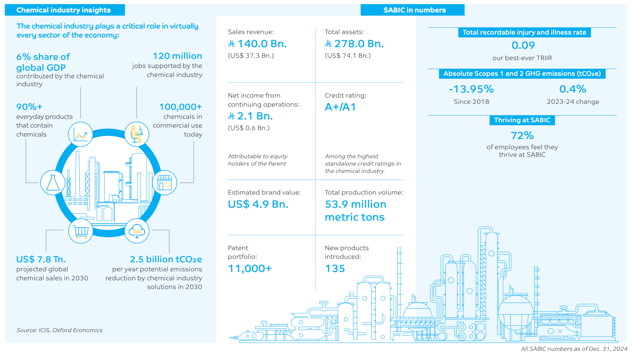

Currently 70% of SABIC’s shares are owned by the energy company Saudi Aramco, with the remaining 30% publicly traded on the Saudi stock exchange.

SABIC’s industrial segments also cover agriculture, automotive, buildings and construction, consumer, electrical and electronics, and healthcare and hygiene.